Master Investment Analysis Through Expert Guidance

Transform complex financial concepts into practical skills with proven learning strategies developed by Australia's leading investment professionals

Learning From Real Market Experience

Investment analysis isn't something you master from textbooks alone. The nuances of market behaviour, the subtle patterns that separate successful investors from the rest — these insights come from years of hands-on experience and careful observation.

Our learning approach bridges the gap between academic theory and real-world application. You'll work through actual case studies from the Australian market, examining both successful investments and valuable lessons from market downturns.

Rather than memorising formulas, you'll understand why certain metrics matter in different market conditions. This contextual learning helps you develop the intuitive understanding that experienced analysts rely on daily.

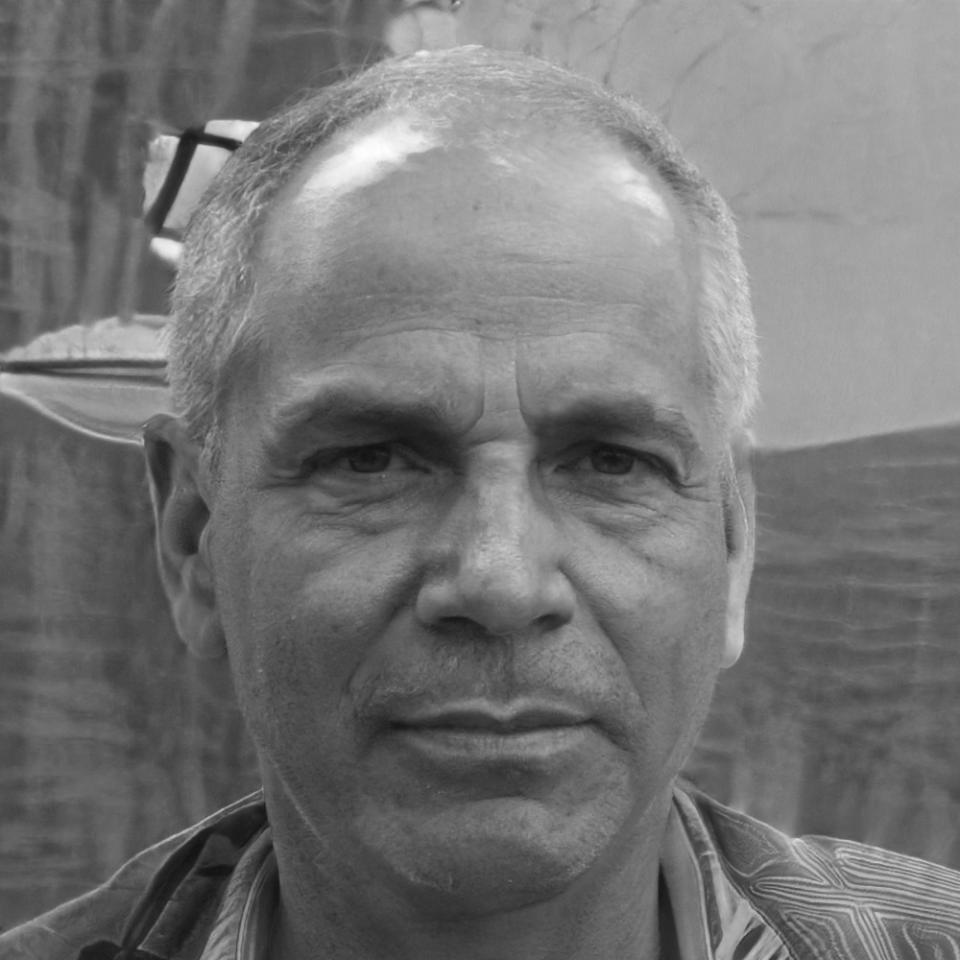

Marcus Broadhurst

Senior Investment Strategist

With over 15 years analysing Australian equity markets, Marcus specialises in teaching practical valuation techniques and risk assessment strategies that work in real trading environments.

Proven Learning Methods That Actually Work

These aren't theoretical approaches — they're battle-tested strategies we've refined through teaching hundreds of successful investment analysts

Start With What You Know

Begin analysing companies in industries you understand. If you work in retail, start with retail stocks. This familiarity helps you spot what traditional financial metrics might miss — like changing consumer preferences or operational challenges.

Build Your Pattern Library

Keep a journal of investment decisions — both your own and those you study. Note what factors influenced each decision and track outcomes. Over time, you'll recognise recurring patterns that signal opportunity or risk.

Question Every Assumption

When analysing any investment, ask "What would need to change for this to fail?" This reverse thinking often reveals hidden risks that standard analysis overlooks. It's the difference between following a checklist and truly understanding an investment.

Practice During Quiet Markets

Use low-volatility periods to hone your skills without pressure. Analyse companies thoroughly, make hypothetical investments, then track how your analysis holds up as events unfold. It's like flight training in clear weather.

Learn From Your Mistakes

Review your unsuccessful analyses as carefully as your successful ones. What warning signs did you miss? Which assumptions proved wrong? These lessons often prove more valuable than any textbook chapter.

Connect Theory to Headlines

When reading financial news, constantly ask how events might affect the companies you're studying. This habit trains you to think like markets think — connecting macro trends to specific investment implications.

Real Results From Focused Learning

Our structured approach doesn't just teach concepts — it develops the analytical instincts that separate competent analysts from exceptional ones. Students consistently report breakthrough moments where complex market dynamics suddenly make sense.

David Kettlewell

Portfolio Strategy

Focuses on helping students develop systematic approaches to investment selection and portfolio construction through hands-on practice with real market scenarios.

Sarah Blackwood

Risk Management

Specialises in teaching practical risk assessment and management strategies, helping students understand how to protect capital while pursuing growth opportunities.

Personal Guidance That Makes The Difference

Investment analysis is as much art as science. While we can teach you the frameworks and methodologies, developing market intuition requires personalised feedback and guidance from experienced professionals.

- Weekly one-on-one sessions to review your analysis work and discuss market developments that affect your learning focus areas

- Access to mentors' personal networks for industry insights and career guidance tailored to Australian financial markets

- Real-time feedback on investment thesis development, helping you refine your reasoning and presentation skills

- Customised learning paths based on your background, interests, and career objectives within investment analysis

- Practice sessions using actual market conditions, with mentors guiding you through complex scenarios and decision-making processes